Build Your Dream Ride with Mia

Are Aftermarket Parts Covered by Insurance?

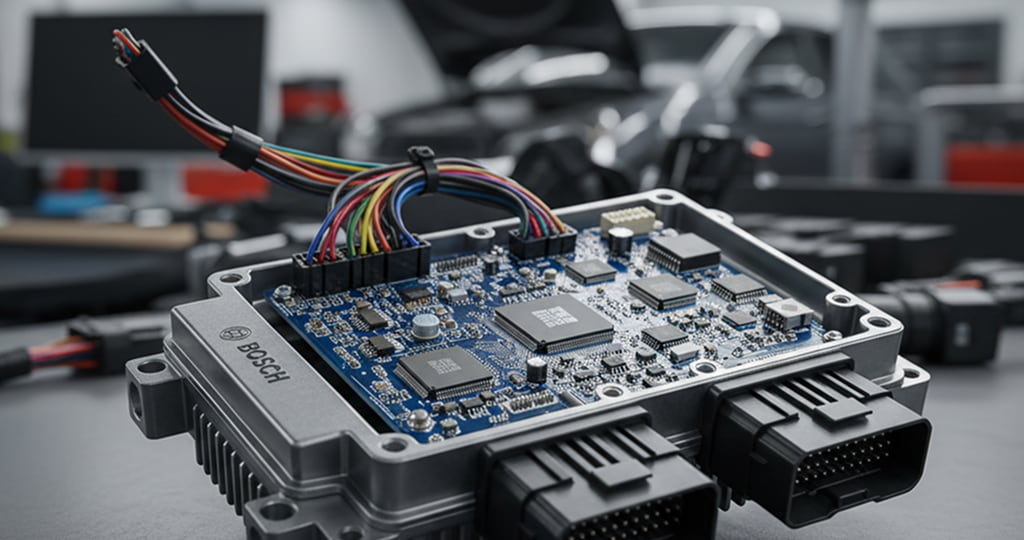

You just dropped serious cash on that turbo kit, custom wheels, and performance exhaust. Your ride looks and performs exactly how you dreamed. Then comes the thought: what happens if someone rear-ends you at a stoplight?

Here’s what most enthusiasts need to know: standard auto insurance policies treat your aftermarket parts like they don’t exist. That cold air intake you installed last weekend? Your insurance company doesn’t know or care about it unless you’ve taken specific steps to protect your investment.

Even worse, without proper documentation of your build’s “provenance” which is the complete record of all services, parts, and modifications, you could be leaving serious money on the table. Strong provenance can increase your vehicle’s value by up to 20%, making documentation just as important as the parts themselves.

The smart money goes toward specialty insurers who understand modified vehicles. Companies like Hagerty, Grundy, and American Collectors Insurance built their reputations specifically serving enthusiasts who’ve invested heavily in their rides. These insurers recognize that your $30,000 Civic with $15,000 in modifications isn’t just transportation, it’s a passion project needing proper protection.

If you’re planning future mods, MotorMia’s AI-powered app can help you discover parts that fit your ride perfectly while connecting you with trusted suppliers.

Plus, with our newly launched Glovebox feature, you can scan and store all your service documents, mod purchases, and insurance paperwork in one secure location, building the documentation trail that insurers love to see.

Are aftermarket parts covered by insurance?

Insurance may cover aftermarket parts, but only if your policy includes specific endorsements or if the insurer deems the parts equivalent to original equipment. Standard auto insurance typically covers factory parts unless you notify the insurer about aftermarket upgrades and pay additional premiums.

The good news is you can protect your modifications, but it requires being proactive and understanding exactly how insurance companies handle aftermarket parts. Whether you’re running subtle OEM+ upgrades or a full show car build, knowing your coverage options before disaster strikes makes the difference between getting reimbursed and eating the loss.

How car insurance typically handles aftermarket parts

Insurance companies have a complicated relationship with aftermarket parts, as insurance companies in the US vary widely in how they handle aftermarket parts and modifications, depending on the company and state.

When it comes to repairs, insurers often prefer aftermarket parts over OEM replacements because they’re cheaper. But when covering your personal modifications, they suddenly become much less enthusiastic.

The disconnect stems from how insurance companies view vehicle value. To them, your car is worth its book value based on year, make, model, and mileage. Those $3,000 wheels don’t factor into their calculations unless you’ve specifically added coverage for them.

Standard auto insurance coverage explained

Your basic auto insurance covers the actual cash value (ACV) of your vehicle, which means the depreciated value of the stock car. Comprehensive and collision coverage will pay to repair or replace your vehicle up to this ACV, minus your deductible.

Standard policies typically exclude equipment not installed by the manufacturer. Even “full coverage” doesn’t automatically protect modifications. Some standard US policies include minimal coverage for aftermarket parts, typically capped at $500 to $1,500, but this requires documentation and varies by insurer.

Do insurance companies cover the value of upgrades?

Not without additional coverage. Insurance companies view modifications as voluntary additions that increase risk without increasing the base value they’re insuring. From their perspective, that turbo kit makes your car more likely to be stolen or crashed.

This becomes painfully clear during total loss settlements. You might have $15,000 in modifications on a car with a $20,000 book value, but standard insurance only pays that $20,000 ACV. Your mods essentially vanish unless you’ve specifically insured them.

Types of coverage for aftermarket parts

Protecting modifications requires understanding specific coverage options. TThe most common protection method is a Custom Parts and Equipment (CPE) coverage endorsement, sometimes called “accessory coverage” which specifically covers modifications above your policy’s basic limits.

Custom parts and equipment (CPE) coverage

CPE coverage protects aftermarket parts and modifications with limits that match your investment. This coverage typically includes permanently installed parts like engine modifications, custom paint, wheels, and suspension upgrades.

CPE usually pays on an actual cash value basis, meaning depreciation applies. Some insurers offer agreed value coverage where you and the company agree on values upfront, eliminating depreciation disputes during claims.

How much coverage do I get for aftermarket versus OEM parts

Most standard policies include between $500 and $1,500 in aftermarket coverage, which falls short for serious modifications. Meanwhile, OEM parts damaged in the same accident get full coverage up to policy limits.

Insurance companies defend using aftermarket parts in repairs by claiming they’re “equivalent quality” to OEM. Yet when covering your modifications, they treat them as risky additions requiring extra premiums.

How to get your aftermarket parts covered

Protecting modifications requires different approaches depending on whether you choose standard or specialty insurance. Both paths will need proper documentation, but specialty insurers streamline the process considerably.

Notify your insurer immediately after modifying

Be completely honest during notification because omissions become claim denials later. Standard insurers treat undisclosed modifications as policy violations, while specialty insurers simply want accurate valuations for proper coverage.

Specialty insurers can also handle this differently. For example, Hagerty customers can update their agreed values annually or when making significant modifications, but minor changes don’t require immediate notification. Their policies assume enthusiasts continuously improve their vehicles.

Request custom equipment coverage

Don’t assume your agent knows about CPE coverage. Be specific about your needs, stating exact coverage amounts rather than vague requests. Consider specialty insurers if your regular company can’t provide adequate coverage.

Get quotes from multiple sources. American Collectors Insurance, Grundy, and Hagerty all serve enthusiast markets but have different specialties and pricing structures depending on vehicle types and usage.

What happens after an accident?

Claims involving modified vehicles take longer and involve more scrutiny. Adjusters evaluate both factory components and modifications, often bringing in specialists who understand aftermarket values.

Will insurance pay for damaged aftermarket parts?

With proper CPE coverage, damaged aftermarket parts get treated like any other claim. Without it, you’re likely out of luck beyond token amounts. Even with coverage, disputes about values can arise, making documentation crucial.

How claims are evaluated and settled

Modified vehicle claims follow complex evaluation. The adjuster determines what’s stock versus modified, then checks coverage. Valuation becomes contentious as insurance might use generic databases that don’t reflect quality differences. Total loss settlements get especially complicated with disagreements about modification values.

Common misconceptions about insurance and aftermarket parts

Enthusiasts share plenty of insurance myths that lead to expensive surprises. Understanding reality versus wishful thinking protects your wallet and build.

All mods are automatically covered

Your comprehensive and collision coverage don’t expand to include whatever you bolt on. That “full coverage” covers the stock vehicle value, nothing more. Even dealer-installed options might need additional coverage if they weren’t part of the original purchase.

You don’t need to disclose modifications

Playing hide-and-seek with insurers ends badly. Failing to disclose modifications gives insurers grounds to deny claims or cancel coverage entirely. Transparency is always safest, and many modifications don’t impact premiums as much as feared.

Conclusion

Protecting aftermarket parts requires more planning than most enthusiasts realize. Standard policies treat modifications as invisible until you specifically add coverage. The gap between what you’ve spent and what insurance covers can devastate finances after an accident.

The solution requires proactive steps: document every modification, notify your insurer immediately, and ensure adequate CPE coverage. Yes, premiums increase, but that cost pales compared to losses after a claim.

Smart enthusiasts protect investments with proper coverage. Don’t let misconceptions leave you exposed. Get the coverage you need, maintain documentation, and drive confidently knowing your build is protected.

FAQ

Does full coverage insurance include aftermarket parts?

Full coverage insurance does not automatically include aftermarket parts. Most policies cover only original manufacturer parts unless you add a special rider or endorsement. To insure custom parts like rims, sound systems, or spoilers, you must declare them and pay a higher premium.

How much does custom parts coverage cost?

Expect to pay roughly 5% to 15% of the insured modification value annually. So $10,000 in modification coverage might add $500 to $1,500 to your annual premium. Performance modifications cost more to insure than cosmetic ones.

Can you insure a car with performance modifications?

You can insure a car with performance modifications by purchasing a modified car insurance policy. These policies cover enhancements like turbochargers, engine swaps, or suspension upgrades. Insurers may require an appraisal and charge higher premiums due to increased risk.